Thank you for visiting!

First, are solar panels recyclable? Yes. Click here for more information.

Second, can solar save you money? See the California Solar Consumer Protection Guide here. The first question to ask yourself is this: "When will I have my electric bill paid off?" Of course, the answer is a resounding "Never!" A properly sized and priced solar pv system can reduce your power costs significantly, like 50% or more, and the value increase to your property has been determined in 2011 by Berkeley Labs to be as high as $6.50/watt, and lately closer to $4. So, if you bought it, paid for it over time, then sold your home, you not only paid nothing, but you also actually saved tens of thousands of dollars (hundreds of thousands if your present bill is higher). Compare that to never being able to pay off your regular electric bill today without solar. Solar is a means of investing in yourself rather than your local utility.

You will never pay off your utility. You can pay off your solar and end your power costs. The key to solar is the cost. Studies show that solar on the roof can keep the home cooler and save roofing materials from direct attack of ultraviolet radiation from the Sun. So many ways to save your money...

You will never pay off your utility. You can pay off your solar and end your power costs. The key to solar is the cost. Studies show that solar on the roof can keep the home cooler and save roofing materials from direct attack of ultraviolet radiation from the Sun. So many ways to save your money...

Third, is solar free? This is a frequently promoted marketing phrase, like "go solar for free" or "no up front costs." It's not free, because you have to pay for it. Loans are typically available, so there are not any up front costs with most solar loans. The maximum deposit allowed in California is $1,000 or 10% whichever is less. The way it is promoted it sounds like you pay nothing. The reality is that you pay less than you pay your utility, and eventually nothing if you sell your house. For example, if your current utility bill is $300, and the solar to replace the electric power from your utility is a monthly loan payment of $150, then you saved $150. It's not yet free, it's just less than you are paying now, and can be free later depending if you sell your home. As of 2015 in a more recent Berkeley study, if you sell your home, the $4/watt increase in value (CA) from adding solar could offset the initial cash cost of the system. For example, if the system cost was $25,000 and you got to take the current 30% tax credit on that $25,000, or $7,500, then your net cost was $17,500. However, if the system size were 6250 watts, your recovery would be $25,000, so you profit $7,500 due to the tax credit. So, is it free? Better than free. If you sell, you wind up paying nothing for solar (properly designed) while receiving no cost for electricity while you live in the home. It is a tax-free investment that pays big dividends over time. In any case, you are in a better position to pay for electricity and could save tens (or hundreds) of thousands of dollars over the life of the solar pv array.

This is why solar is considered an investment, not a purchase.

Here's an example:

Net cost of solar: $18,500. You used to pay $300 to your utility. You now pay $141 for a loan per month. You saved $159 per month. ($159x12)/$18,500 = 10.3%. This is essentially a 10.3% tax-free return on investment.

This is why solar is considered an investment, not a purchase.

Here's an example:

Net cost of solar: $18,500. You used to pay $300 to your utility. You now pay $141 for a loan per month. You saved $159 per month. ($159x12)/$18,500 = 10.3%. This is essentially a 10.3% tax-free return on investment.

Fourth, can I cover the costs of any problems that may occur for the next 30 years with a transferable warranty that covers all labor and materials? It is possible under some conditions, but you should know that there are typically very few, if any, problems with solar equipment, and they are generally covered by the manufacturers for up to 30 years. In CA it is a law that the installer must give a 10 year labor warranty for solar. It is best to have separate insurance just in case the contractor has gone out of business.

About us: We are a veteran-owned business, have an A+ rating with the Better Business Bureau (BBB), a complaint-free record with Yelp and the California Contractors' Board. Our mission is to provide high-quality residential and commercial solar at fair prices in order to save the environment.

We have found that many homeowners were given high prices in the past by many companies, and therefore think solar is not for them, when actually it can be very profitable, affordable, and most of all the right thing to do. If you feel that this is the case for you, please contact us for a fair quote. With the right pricing, you start saving immediately. Normally, you would save tens of thousands of dollars in electric costs. A loan creates a flat payment, less than what you are paying your utility. However, the utility prices would keep rising while the loan payment would not. Now, with NEM-3, a battery is often added. You can also go "off grid" if you add a generator for those days when solar is not enough, such as winter.

One problem we hear about on solar installations from videos on YouTube is that the system is not designed properly and does not cover all the costs of electricity from the utility. This may happen for two reasons: (1) the homeowner uses more power after getting solar and exceeds the design planned in the original project, or (2) the solar company undersized the system to appear to cost less than a competitor. In our design work, we will make absolutely sure that you know what your system will provide before you sign any paperwork. Another issue is misleading or pressuring the customer. We value our reputation and your time, so if our presentation of the system and its cost is not clear and concise enough for you, please take your time to evaluate the project, ask questions, do your research, and get back to us when you are satisfied that we are correct and you are ready to proceed. Our reputation is everything to us, and we hope you will give us a glowing review after you have seen your project completed and performing as we presented it to you. You will be able to monitor your system, and you will be able to determine if it is working properly. You will always be able to contact us by phone directly. We pick up our phone and answer because we know you need answers now, not later.

Another factor that has become important in designing the solar pv system is the new NEM-3 rate changes. You may need to add additional panels to compensate for the low excess generation rate or low reimbursement rate for time of use. For example, you generate surplus power from 10 am to 3 pm, but you use high cost peak power between 5 pm and 8 pm. How much surplus power would you need to offset the evening rate increase? Typically, it depends on how much power you are expecting to use between 5 pm and 8 pm. That, combined with the steep hourly rate increase, can help determine how much extra power to generate. Under NEM-3 you can install up to 50% more than you would usually need to cover past rates. The extra panels could build up a large reserve of power credit, which could offset the high evening rates. This can be a better option that adding batteries in some cases, because solar panels last much longer than batteries. Otherwise, you could also add batteries to charge by day and use during the evening rate increase, but the payback for batteries that need replacement every 10 years could be a bad investment if the batteries are priced too high. A few more panels would cost a great deal less and last longer than batteries.

Many people wait for a lifetime for an opportunity like this to come along. You are finally in a perfect scenario: low prices, high quality, low interest funding, while the utilities are rapidly increasing their rates. This is the time to act. If your property is shaded by trees, you may want to clear a space for solar unless the trees are worth more than $100,000 to you. (Utilities that offered free trees for shading in the past have essentially created a barrier against solar. Solar also protects roofing surfaces from ultraviolet light damage, and reduces summer heat through roof decking). SMUD has already created their new rate plan for solar as of Mar 2022, so you missed that. PG&E allowed the NEM-2 rates up until about April 15, 2023, but that date has passed, also. Now we have to get creative to offset the power costs. PG&E is now working on additional charges to accounts.

We have found that many homeowners were given high prices in the past by many companies, and therefore think solar is not for them, when actually it can be very profitable, affordable, and most of all the right thing to do. If you feel that this is the case for you, please contact us for a fair quote. With the right pricing, you start saving immediately. Normally, you would save tens of thousands of dollars in electric costs. A loan creates a flat payment, less than what you are paying your utility. However, the utility prices would keep rising while the loan payment would not. Now, with NEM-3, a battery is often added. You can also go "off grid" if you add a generator for those days when solar is not enough, such as winter.

One problem we hear about on solar installations from videos on YouTube is that the system is not designed properly and does not cover all the costs of electricity from the utility. This may happen for two reasons: (1) the homeowner uses more power after getting solar and exceeds the design planned in the original project, or (2) the solar company undersized the system to appear to cost less than a competitor. In our design work, we will make absolutely sure that you know what your system will provide before you sign any paperwork. Another issue is misleading or pressuring the customer. We value our reputation and your time, so if our presentation of the system and its cost is not clear and concise enough for you, please take your time to evaluate the project, ask questions, do your research, and get back to us when you are satisfied that we are correct and you are ready to proceed. Our reputation is everything to us, and we hope you will give us a glowing review after you have seen your project completed and performing as we presented it to you. You will be able to monitor your system, and you will be able to determine if it is working properly. You will always be able to contact us by phone directly. We pick up our phone and answer because we know you need answers now, not later.

Another factor that has become important in designing the solar pv system is the new NEM-3 rate changes. You may need to add additional panels to compensate for the low excess generation rate or low reimbursement rate for time of use. For example, you generate surplus power from 10 am to 3 pm, but you use high cost peak power between 5 pm and 8 pm. How much surplus power would you need to offset the evening rate increase? Typically, it depends on how much power you are expecting to use between 5 pm and 8 pm. That, combined with the steep hourly rate increase, can help determine how much extra power to generate. Under NEM-3 you can install up to 50% more than you would usually need to cover past rates. The extra panels could build up a large reserve of power credit, which could offset the high evening rates. This can be a better option that adding batteries in some cases, because solar panels last much longer than batteries. Otherwise, you could also add batteries to charge by day and use during the evening rate increase, but the payback for batteries that need replacement every 10 years could be a bad investment if the batteries are priced too high. A few more panels would cost a great deal less and last longer than batteries.

Many people wait for a lifetime for an opportunity like this to come along. You are finally in a perfect scenario: low prices, high quality, low interest funding, while the utilities are rapidly increasing their rates. This is the time to act. If your property is shaded by trees, you may want to clear a space for solar unless the trees are worth more than $100,000 to you. (Utilities that offered free trees for shading in the past have essentially created a barrier against solar. Solar also protects roofing surfaces from ultraviolet light damage, and reduces summer heat through roof decking). SMUD has already created their new rate plan for solar as of Mar 2022, so you missed that. PG&E allowed the NEM-2 rates up until about April 15, 2023, but that date has passed, also. Now we have to get creative to offset the power costs. PG&E is now working on additional charges to accounts.

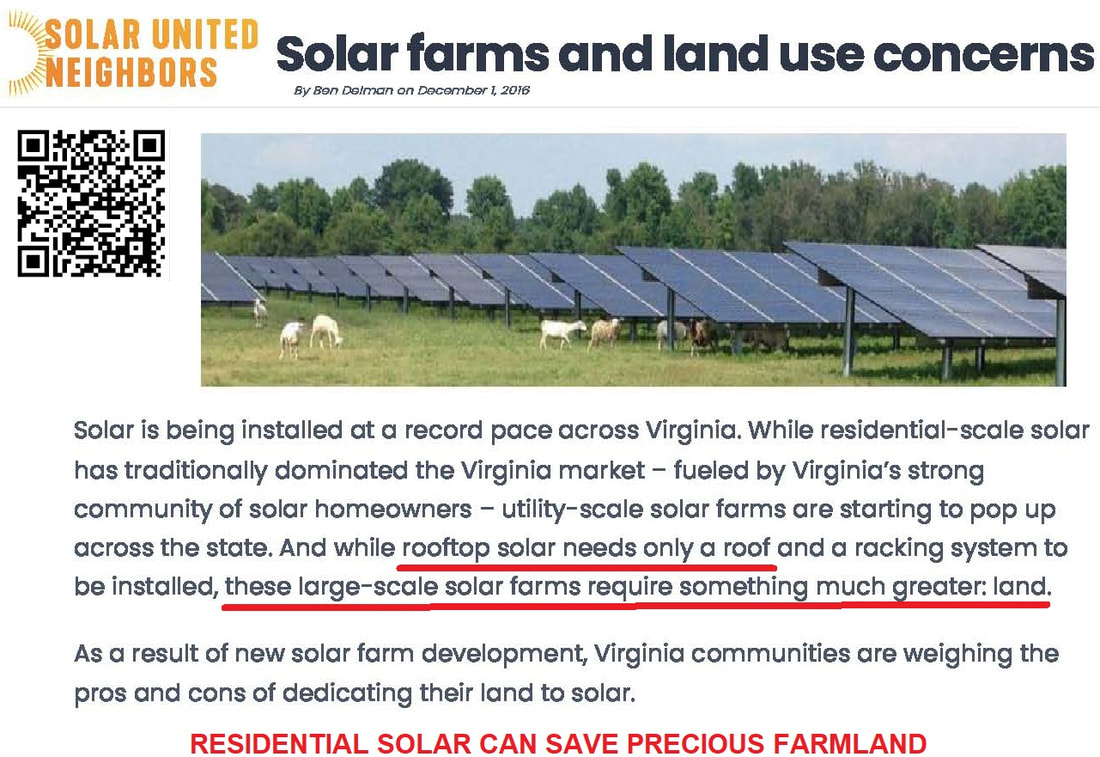

We are facing a problem in the future because population is increasing and safe, environmentally-friendly places to generate power are decreasing, causing the use of large areas of arable land for solar farms rather than food farms. Therefore, we are here to show how solar truly is economical and the right thing to do. We do that by giving great value, and service above average. If you have ever considered solar, now is the time to take another look.

This website is intended to give you a familiarity with our company, the issues with solar, and hopefully to help you become aware of issues you may not yet know about so you can make better decisions.

If you are in a hurry, please click on the quote button below. Otherwise, happy reading. We have some very educational videos on here, too. Most information is directed toward customers of PG&E because they have the most savings. However, you can see how your rates compare with the links to the utilities at the bottom of this page.

Hope to hear from you soon!

This website is intended to give you a familiarity with our company, the issues with solar, and hopefully to help you become aware of issues you may not yet know about so you can make better decisions.

If you are in a hurry, please click on the quote button below. Otherwise, happy reading. We have some very educational videos on here, too. Most information is directed toward customers of PG&E because they have the most savings. However, you can see how your rates compare with the links to the utilities at the bottom of this page.

Hope to hear from you soon!

What does solar cost? It depends. Here is recent info from California in the PG&E area. Please note that the price of solar WAS relatively the same every year BUT ARE NOW INCREASING, while the utility prices keep SKYROCKETING. See for yourself here. Waiting makes it more expensive. (Think of how much you have already lost by waiting).

How does solar work?

Your home electrical usage efficiency improves with time

Solar panels lose approximately .5 (one half) percent efficiency (.005) per year, but the average home is improving efficiency at 2.02 percent per year (.0202). Therefore, if you get 100% of your power needs covered by solar today, you will have an excess of power production in the future. The following charts show the efficiency mentioned above.

Power companies charge more for electricity with time

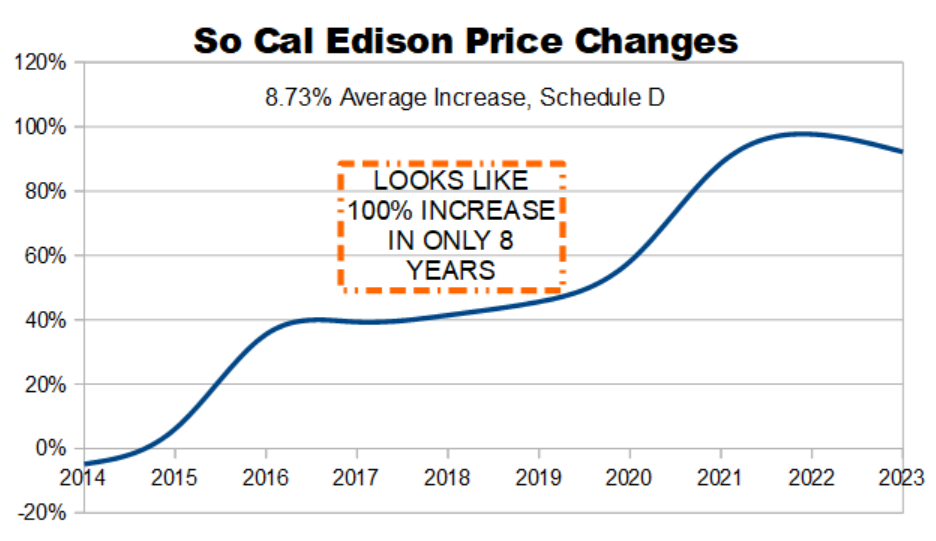

California has the Public Utilities Commission board for deciding to increase rates for electricity. They usually favor increases. Loretta Lynch, former head of the CPUC, has stressed that the meetings behind closed doors often result in higher rates for consumers. The customer cannot opt out and select another electric utility. He can only become his own provider with solar. For example, PG&E rates have recently increased (Tiers 1 - 3 have increased an average of 10.2% per year 2013-2024. Inflation, wages, and cost of living have been near or below 2%, but that has now changed dramatically. Rates are increasing faster than the user can budget, with inflation on the rise and wages slow to increase. 2024 is even higher, so it is smarter to act now before these rate changes can apply to you so that you can grandfather these new policies. Now is the time to lock in low rates.

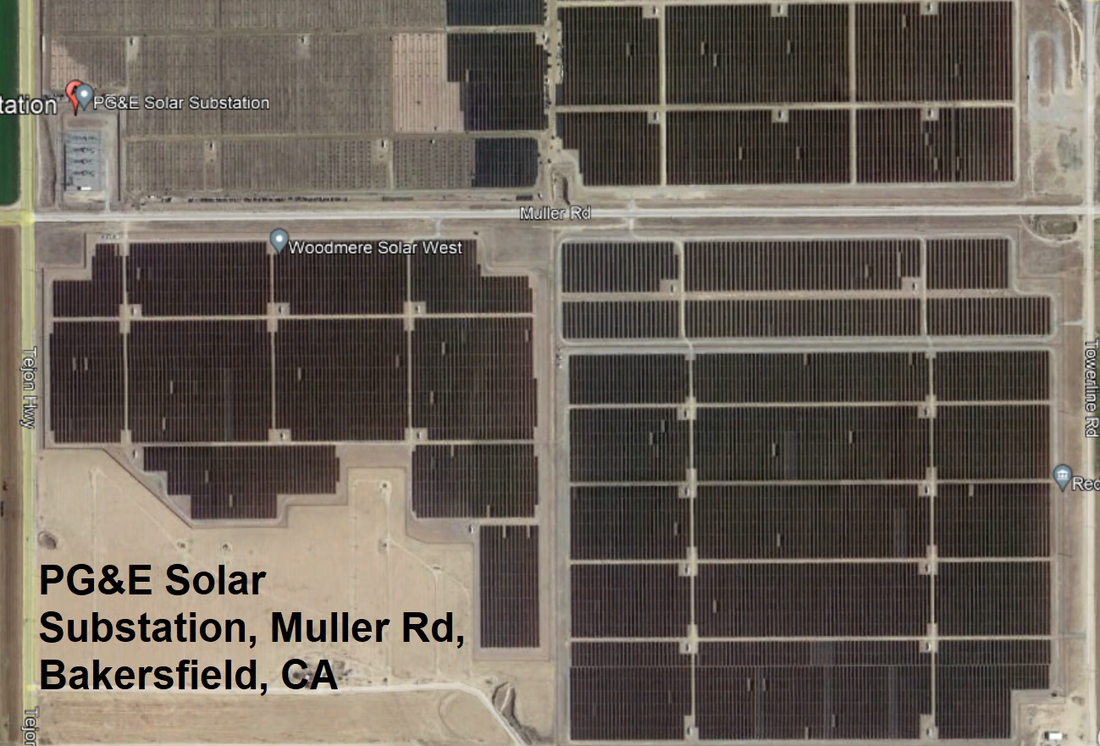

PG&E is investing in solar energy, and has already reached 38% as of Feb 2022 in renewable energy sources. The next goal is 50% in 2030. Rates are steadily increasing, partially to finance this improvement, and to pay for infrastructure. You can continue to pay for electricity with PG&E and have them buy solar elsewhere to provide power to you, or you can remove your demand for electricity from PG&E by investing in solar for yourself and sell your solar power to PG&E, or whatever utility you are with. Pay yourself, not your utility. Please note how the following charts show those rate increases, and how they outpace the cost of living, wages, and inflation. This runaway expense is like an adjustable rate loan that keeps adding more interest and increasing the payments each year, without building equity. Would you want a loan like that? Or does it make more sense to get a temporary loan to pay for solar and then eventually become independent without any electricity costs? Wake up, California! Vote with your wallet! The average annual salary on the PG&E management board has been $3 million each. Their management for you is to keep increasing your bill. Why aren't you doing something about it when the solution is so easy? As a rule of thumb, what if you could save $100,000 over the next 25 years for every $100 you pay on your bill today?

PG&E is investing in solar energy, and has already reached 38% as of Feb 2022 in renewable energy sources. The next goal is 50% in 2030. Rates are steadily increasing, partially to finance this improvement, and to pay for infrastructure. You can continue to pay for electricity with PG&E and have them buy solar elsewhere to provide power to you, or you can remove your demand for electricity from PG&E by investing in solar for yourself and sell your solar power to PG&E, or whatever utility you are with. Pay yourself, not your utility. Please note how the following charts show those rate increases, and how they outpace the cost of living, wages, and inflation. This runaway expense is like an adjustable rate loan that keeps adding more interest and increasing the payments each year, without building equity. Would you want a loan like that? Or does it make more sense to get a temporary loan to pay for solar and then eventually become independent without any electricity costs? Wake up, California! Vote with your wallet! The average annual salary on the PG&E management board has been $3 million each. Their management for you is to keep increasing your bill. Why aren't you doing something about it when the solution is so easy? As a rule of thumb, what if you could save $100,000 over the next 25 years for every $100 you pay on your bill today?

The cost of solar has started increasing. Does it make a difference?

The cost to install a solar system had leveled off between 2018 and 2023, but is now increasing in late 2024. The chart below shows solar costs in early 2024. On top of that, the cost of electricity has been increasing faster than ever. Therefore, waiting is not to your advantage.

TIME IS OF THE ESSENCE. RULES ARE CHANGING.

You missed the utility rebates. You missed the NEM-2 reimbursement program. Keep waiting and you will also miss the CA property tax exclusion that ends on Jan 1, 2025 and the coming customer added costs.

SOLAR IS AN INVESTMENT.

Solar is not considered a purchase. It is an investment that pays dividends.

Solar produces income as a tax-free investment, often over 10% to up to 40% return. You decide if you want to pay yourself or pay your utility. Solar does not increase property tax in California, but studies show it does increase property value by 4.1%, approximately the cost of the solar, and can add to the rapid sale of the home. It is a significant and wonderful investment in improving the environment.

Your solar system shuts down when the grid goes down? Not necessarily. New tech with batteries make a difference.

Your solar system is connected to the grid in almost all cases. Since you are producing power, your system must disconnect from the grid automatically to prevent electric shock to electrical repair crews servicing the grid. You can avoid this by using a battery backup system or a generator, or both. The grid is reliable enough to avoid the cost of a battery backup system, in most cases. However, with the new rules for power costs during peak periods, batteries are charged in the early part of the day and used to power the home during peak periods to avoid high rates. Batteries are currently more affordable than in the past, have rebates, and need replacement about every 10-20 years. Generators last up to 25 years or longer depending on usage. It is possible to keep power when the grid goes down with new technology, which is affordable. Even though batteries add to the cost, it is easily recouped in zones where utilities charge high prices.

Batteries and generators used to be mainly used in areas where power is frequently lost, as in forests where trees fall on lines. You may want to consider this system if you have critical needs, e.g.; medical. With the low reimbursement rates for power, a generator running on natural gas can help during the winter. As gas prices skyrocket, generators become more costly to use. On the bright side, it is possible to have power during blackouts with solar, as special equipment has been created to provide power during the daytime without sending power to the grid.

Batteries are useful for several hours under normal loads. If you are expecting to be out of power for lengthy times, you may need several batteries. LiFePO3, or Lithium Iron Phosphate, batteries seem to be doing the best for holding a charge and allowing for a deep discharge; i.e., more power for longer.

Batteries and generators used to be mainly used in areas where power is frequently lost, as in forests where trees fall on lines. You may want to consider this system if you have critical needs, e.g.; medical. With the low reimbursement rates for power, a generator running on natural gas can help during the winter. As gas prices skyrocket, generators become more costly to use. On the bright side, it is possible to have power during blackouts with solar, as special equipment has been created to provide power during the daytime without sending power to the grid.

Batteries are useful for several hours under normal loads. If you are expecting to be out of power for lengthy times, you may need several batteries. LiFePO3, or Lithium Iron Phosphate, batteries seem to be doing the best for holding a charge and allowing for a deep discharge; i.e., more power for longer.

You get credit for the power you produce.

You produce a lot of power on sunny days, but you also need power at night or in winter. You will be given a small credit for overproduction when you need power during times of scarcity. Your power meter literally runs backward. On smart meters, you will see a pair of horizontal lines moving from right to left. Your system size determines how much production you will make. It can be designed to cover all your power needs either directly or through credit created by reversing the meter flow indication. When you send your power to the grid faster than you are using it, or in other words your excess power, your meter "spins backwards" or registers digitally as reversing flow. You should not expect any significant reimbursement from your utility, so it is best to design your system to take care of all your needs and no more. If you have been rationing power because of high utility charges, you need to allow for that in designing your system to be putting out that extra power, up to 20% more, as most customers use more power when they have solar. Families want to be comfortable in their homes during summer and winter, so it makes sense to make your system large enough to carry that need.

Ways to pay for solar power installation

There are at least three ways to buy solar: purchase, lease, or power purchase agreement (PPA). There are many ways to purchase solar with financing, including conventional unsecured credit, secured loans, and Property Assessed Clean Energy financing (PACE) (usually the lowest monthly payment). Lease and power purchase agreements do not allow you to take the 30% residential energy tax credit because you do not own the solar pv system, therefore they do not have a 30% lower cost as do when you own the system with regular or PACE financing.

PACE financing creates a small bond assessment on your property, adding to your property tax payment. The PACE payment will pass to the buyer of your property, but most sellers pay it off at the sale. PACE payments can be financed, and the term depends on the program (some offering up to or over 20 years). PACE programs carry an interest rate whose initial application rate could change to match market rates and thereafter remains fixed for most programs today. So, depending on your needs, you may want to pay it off quickly or get solar with no down payment and minimum monthly payments. PACE interest may be tax-deductible, thereby lowering your monthly energy rate again thanks to the combined effect of the residential energy tax credit (30% off) and the deductible interest (your tax bracket off the interest on the PACE payments). PACE is usually a county-specific program. More on PACE below:

Financing solar:

1. You want to buy with cash. This works well because it avoids any finance charges at the purchase side. It also works well if you are currently getting very little growth on your finances. Typically in PG&E, for example, you could realize a 10 - 20% tax-free return on your investment, and much more if you are getting a bigger solar installation.

2. You plan to sell your property soon. PACE is the program for you. You can sell the property for a higher appraised amount, while walking away from the payments because they pass to the new property owner as property tax if you don't pay it off with the proceeds of the sale in escrow. Either way, you must divulge tax obligation in the sale. Best plan: pay it off for the new buyer from the added solar profits of your home sale.

Be aware that any lease or power purchase agreement can hinder the sale of your home. If the buyer will use much less power (e.g., no spa) he won't see a need for all that solar (not a factor if purchased instead of leased or power purchase agreement). The buyer could be paying a lease or PPA cost much higher than they would normally pay for power or be reimbursed by the utility. If you try to pre-pay the lease, you must normally pay all the lease payments for the lease period (e.g., 20 years) at the time of the property sale: tens of thousands of dollars; then, at the end, the leased panels are removed anyway (though some have not been). You may not be able to move the panels from your home to your next home if they are leased/PPA either, if the next property gets insufficient sun, because you don't own them.

3. You have a credit problem. PACE may work for you, as it does not look at nor affect your credit, other than an initial credit check. It does not create a debt, per se, that can show on your credit report. PACE will not necessarily work in all cases, as it has a few requirements of its own: no bankruptcies in at least the past 2 years, current on mortgage and property tax payments for past 2 years, and you must have at least 10 - 15% equity in the property not including the value of the new improvements. Click here to see if PACE is in your area. PACE financing can add to difficulty in refinancing or getting home equity loans in some cases. PACE is most effective for poor credit where the homeowner plans to live in the home and not take out equity.

Additionally, more lenders are reducing their credit score requirements to the mid 500's. You may be able to get an excellent solar loan with fair credit.

4. You want cheap power. Leasing may be for you if your credit score is at least around 650. It's always better to own your system, but at least a lease allows you to drop your power costs to around your bottom tier cost. That means you may pay the bottom tier cost or less, even for the top tier energy. The reason: you are generating the power, and the cost per month of the lease equals a low price per kilowatt-hour (kW-h) which is essentially about what you would be paying now for your lowest cost (Tier 1) rate. In many cases, you may be paying even below that. An advantage to leasing: you can lock in a flat rate for 20 years and pass the maintenance costs (if any) on to the lessor. For example, 20 years from now when your bill would have been 3 times what it is today, you will still be paying today's price. Selling the property means transferring the lease to the buyer, and you may be able to expect some help from the lessor to make this as easy as possible. Of course, cheap power helps sell your home, so the longer you are in the lease the more attractive your home will be for sale. Additionally, at the end of the lease you are in a great position to bargain for a low cost purchase of the system because the lessor has no benefit in removing your system. BEWARE OF THE LEASE ESCALATOR. IT SHOULD READ ZERO PERCENT! This can make your lease increase annually On the other hand, if you didn't buy the system, you are still making payments on a lease, indefinitely. Buying is better in most cases. Read the fine print in the lease. You may be stuck with paying off the lease in order to sell the home.

Let's compare leasing versus buying in PG&E. If, for example, you are using 12000 kwh (kilowatt-hour) per year, that's 1000 per month. At that usage, you are paying around $351 per month average. You pay an average of 34.1 cents per kwh. Let's say your lease offers you 19 cents per kwh without a lease escalator so the rate always stays 19 cents for 20 years. That means you will pay 12000 x .19 x 20 years = $45,600 without the escalator. Let's compare that to buying the system day one, panels facing south. It takes an 8.8 DC KW solar panel array to remove the entire bill. The cost of $3.50 per watt makes the solar panels cost $3.50 x 8800 = $30,800. Now we take the tax credit of 30% off that total of $26,400 and we have a system cost of $18,480. Which is better: $18,480 or $45,600? Worried about maintenance? Panels and micro-inverters may be guaranteed for 30 years or be maintenance-free, better than any lease. Solar must come with a ten year labor warranty in California, by law. Surely if there is a problem with the system it will show up in 10 years. There are no moving parts. There is 30 year insurance available in some cases.

Is it economical to buy a system in SMUD? SMUD rates were so low, but changed to more expensive time-of-use rates in 2019. For now, let's take a look: Let's use the same example, where you are using 1000 kwh per month. Your monthly bill in SMUD would be seasonally averaged at $196/month. We already know from the first example that it requires 8.8 DC KW in solar panels to remove the 1000 kwh/mo usage. Assuming SMUD rates do not change, how long would it take to break even on the solar panels? The solar panels net cost after tax rebate is $18,480. Your SMUD usage divided into that amount will give the number of months, and the years come out to 11.4. So, after 11.4 years, you pay nothing at all for electrical power for decades. From an investment standpoint, you put $22,792 into the investment and got out $1,620 per year, or 7.1% tax free interest on the investment. This is a cash example. Loan rates can make the payback period longer. High utility rates in 2019 make the payback period shorter and the return on investment higher. SMUD was planning to charge $8 per installed 1 DC KW effective 1 July 2019, but decided to not do so (yet). That charge would not have been placed against systems in use, only on newly installed ones. So, practically, if you had a $220 bill average with SMUD, you would have needed a system size of 12.3 DC KW, and SMUD would have added 12.3 times $8 plus the monthly account charge. Your $220 system that was supposed to zero out your solar bill would still cost $98.40 plus the monthly account charge. That would effective double the number of years to pay off the system. Thankfully, SMUD changed their mind for now, but they have reduced the amount they will pay for excess generation by about 80% and will not normally allow systems to be designed for much more than your historic need. SMUD is finding ways to discourage rooftop solar, adding additional costs, also.

In either case above, if you are selling the home you reap the reward of getting a lot of your money back (about $4 per watt of your solar pv system) because the appraised value of the home increased. If you buy your system on PACE financing, the cost may be able to pass to the buyer of your home as property tax and you pay nothing more, and at the same time you get the full cost of the solar system paid to you as part of the sale of the home. (With a lease, you need to make sure the buyer can qualify and wants to lease your solar power system). Alternatively, being a nice person that you are, you can also pay off the solar PACE loan with the increased sale value of the home, giving the buyer free energy for life.

PACE financing creates a small bond assessment on your property, adding to your property tax payment. The PACE payment will pass to the buyer of your property, but most sellers pay it off at the sale. PACE payments can be financed, and the term depends on the program (some offering up to or over 20 years). PACE programs carry an interest rate whose initial application rate could change to match market rates and thereafter remains fixed for most programs today. So, depending on your needs, you may want to pay it off quickly or get solar with no down payment and minimum monthly payments. PACE interest may be tax-deductible, thereby lowering your monthly energy rate again thanks to the combined effect of the residential energy tax credit (30% off) and the deductible interest (your tax bracket off the interest on the PACE payments). PACE is usually a county-specific program. More on PACE below:

Financing solar:

1. You want to buy with cash. This works well because it avoids any finance charges at the purchase side. It also works well if you are currently getting very little growth on your finances. Typically in PG&E, for example, you could realize a 10 - 20% tax-free return on your investment, and much more if you are getting a bigger solar installation.

2. You plan to sell your property soon. PACE is the program for you. You can sell the property for a higher appraised amount, while walking away from the payments because they pass to the new property owner as property tax if you don't pay it off with the proceeds of the sale in escrow. Either way, you must divulge tax obligation in the sale. Best plan: pay it off for the new buyer from the added solar profits of your home sale.

Be aware that any lease or power purchase agreement can hinder the sale of your home. If the buyer will use much less power (e.g., no spa) he won't see a need for all that solar (not a factor if purchased instead of leased or power purchase agreement). The buyer could be paying a lease or PPA cost much higher than they would normally pay for power or be reimbursed by the utility. If you try to pre-pay the lease, you must normally pay all the lease payments for the lease period (e.g., 20 years) at the time of the property sale: tens of thousands of dollars; then, at the end, the leased panels are removed anyway (though some have not been). You may not be able to move the panels from your home to your next home if they are leased/PPA either, if the next property gets insufficient sun, because you don't own them.

3. You have a credit problem. PACE may work for you, as it does not look at nor affect your credit, other than an initial credit check. It does not create a debt, per se, that can show on your credit report. PACE will not necessarily work in all cases, as it has a few requirements of its own: no bankruptcies in at least the past 2 years, current on mortgage and property tax payments for past 2 years, and you must have at least 10 - 15% equity in the property not including the value of the new improvements. Click here to see if PACE is in your area. PACE financing can add to difficulty in refinancing or getting home equity loans in some cases. PACE is most effective for poor credit where the homeowner plans to live in the home and not take out equity.

Additionally, more lenders are reducing their credit score requirements to the mid 500's. You may be able to get an excellent solar loan with fair credit.

4. You want cheap power. Leasing may be for you if your credit score is at least around 650. It's always better to own your system, but at least a lease allows you to drop your power costs to around your bottom tier cost. That means you may pay the bottom tier cost or less, even for the top tier energy. The reason: you are generating the power, and the cost per month of the lease equals a low price per kilowatt-hour (kW-h) which is essentially about what you would be paying now for your lowest cost (Tier 1) rate. In many cases, you may be paying even below that. An advantage to leasing: you can lock in a flat rate for 20 years and pass the maintenance costs (if any) on to the lessor. For example, 20 years from now when your bill would have been 3 times what it is today, you will still be paying today's price. Selling the property means transferring the lease to the buyer, and you may be able to expect some help from the lessor to make this as easy as possible. Of course, cheap power helps sell your home, so the longer you are in the lease the more attractive your home will be for sale. Additionally, at the end of the lease you are in a great position to bargain for a low cost purchase of the system because the lessor has no benefit in removing your system. BEWARE OF THE LEASE ESCALATOR. IT SHOULD READ ZERO PERCENT! This can make your lease increase annually On the other hand, if you didn't buy the system, you are still making payments on a lease, indefinitely. Buying is better in most cases. Read the fine print in the lease. You may be stuck with paying off the lease in order to sell the home.

Let's compare leasing versus buying in PG&E. If, for example, you are using 12000 kwh (kilowatt-hour) per year, that's 1000 per month. At that usage, you are paying around $351 per month average. You pay an average of 34.1 cents per kwh. Let's say your lease offers you 19 cents per kwh without a lease escalator so the rate always stays 19 cents for 20 years. That means you will pay 12000 x .19 x 20 years = $45,600 without the escalator. Let's compare that to buying the system day one, panels facing south. It takes an 8.8 DC KW solar panel array to remove the entire bill. The cost of $3.50 per watt makes the solar panels cost $3.50 x 8800 = $30,800. Now we take the tax credit of 30% off that total of $26,400 and we have a system cost of $18,480. Which is better: $18,480 or $45,600? Worried about maintenance? Panels and micro-inverters may be guaranteed for 30 years or be maintenance-free, better than any lease. Solar must come with a ten year labor warranty in California, by law. Surely if there is a problem with the system it will show up in 10 years. There are no moving parts. There is 30 year insurance available in some cases.

Is it economical to buy a system in SMUD? SMUD rates were so low, but changed to more expensive time-of-use rates in 2019. For now, let's take a look: Let's use the same example, where you are using 1000 kwh per month. Your monthly bill in SMUD would be seasonally averaged at $196/month. We already know from the first example that it requires 8.8 DC KW in solar panels to remove the 1000 kwh/mo usage. Assuming SMUD rates do not change, how long would it take to break even on the solar panels? The solar panels net cost after tax rebate is $18,480. Your SMUD usage divided into that amount will give the number of months, and the years come out to 11.4. So, after 11.4 years, you pay nothing at all for electrical power for decades. From an investment standpoint, you put $22,792 into the investment and got out $1,620 per year, or 7.1% tax free interest on the investment. This is a cash example. Loan rates can make the payback period longer. High utility rates in 2019 make the payback period shorter and the return on investment higher. SMUD was planning to charge $8 per installed 1 DC KW effective 1 July 2019, but decided to not do so (yet). That charge would not have been placed against systems in use, only on newly installed ones. So, practically, if you had a $220 bill average with SMUD, you would have needed a system size of 12.3 DC KW, and SMUD would have added 12.3 times $8 plus the monthly account charge. Your $220 system that was supposed to zero out your solar bill would still cost $98.40 plus the monthly account charge. That would effective double the number of years to pay off the system. Thankfully, SMUD changed their mind for now, but they have reduced the amount they will pay for excess generation by about 80% and will not normally allow systems to be designed for much more than your historic need. SMUD is finding ways to discourage rooftop solar, adding additional costs, also.

In either case above, if you are selling the home you reap the reward of getting a lot of your money back (about $4 per watt of your solar pv system) because the appraised value of the home increased. If you buy your system on PACE financing, the cost may be able to pass to the buyer of your home as property tax and you pay nothing more, and at the same time you get the full cost of the solar system paid to you as part of the sale of the home. (With a lease, you need to make sure the buyer can qualify and wants to lease your solar power system). Alternatively, being a nice person that you are, you can also pay off the solar PACE loan with the increased sale value of the home, giving the buyer free energy for life.

THE FEDERAL TAX CREDIT

The Tax Credit

In California, there is no increase in your property tax when you buy solar. Also, any home owners' association cannot prevent solar from being installed.

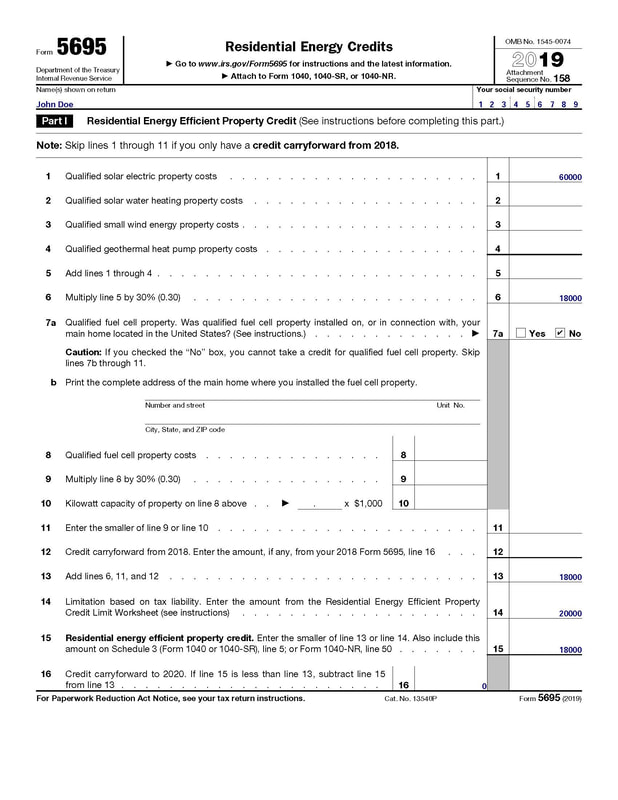

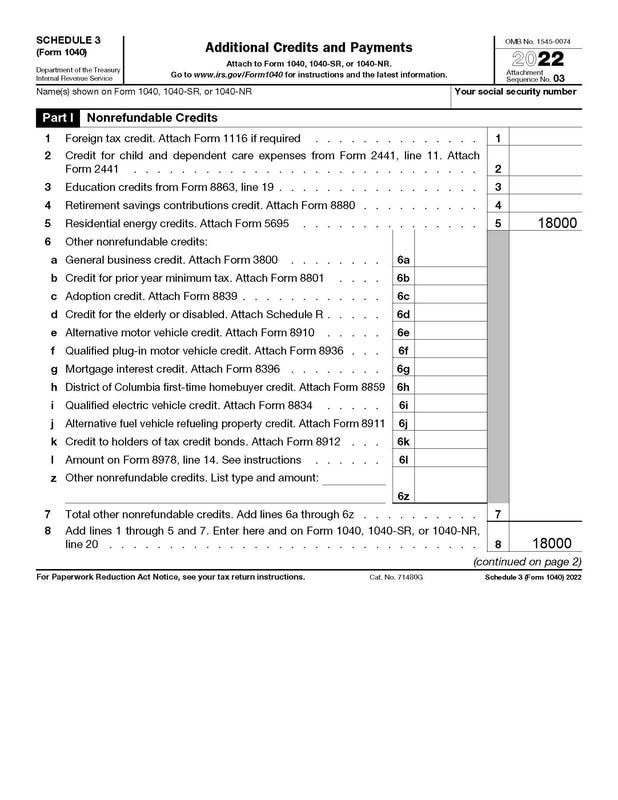

There is also a nice 30% credit for federal taxes, which comes off your tax burden directly (see 1040 line 53 below). The IRS form is here. The instructions for the IRS form are here. Currently, you can expect to reduce the cost of solar pv by 30% through 2033, provided you pay income taxes. Calculate how much income tax is deducted from your paycheck or you may owe at the end of the tax season. Now, multiply the cost of solar by 30%. Compare the two numbers. If your taxes exceed the 30% of solar, you will be able to receive the full 30% tax credit (similar to a refund, in that you can get taxes back if they have been deducted from your paycheck through the year) in one year. If less, you can take portions of it over several years. Prior tax credits were limited to $2000. Now is a great time to exceed the $2000 limit by taking back the full 30% of the cost of the solar. Even without the federal tax credit, solar has many benefits and costs on average less per month than the utility PG&E.

For example, of your solar were to cost $60,000, you would be eligible for a $15600 tax credit. However, if you did not pay $15600 in taxes, you may need to receive some of that tax credit the following year. The Residential Energy Tax Credit is on line 5 of the 1040 Schedule 3 form shown below.

For commercial properties, you will have a different way of saving. You will likely be able to claim the tax credit for your property by using IRS Form 3468. Click here for instructions on how to complete the form. What a great way to help save the environment! Get back some of your hard-earned business income, and use it to do something good for yourself! Add shading for parking, while making your electric bill disappear.

In California, there is no increase in your property tax when you buy solar. Also, any home owners' association cannot prevent solar from being installed.

There is also a nice 30% credit for federal taxes, which comes off your tax burden directly (see 1040 line 53 below). The IRS form is here. The instructions for the IRS form are here. Currently, you can expect to reduce the cost of solar pv by 30% through 2033, provided you pay income taxes. Calculate how much income tax is deducted from your paycheck or you may owe at the end of the tax season. Now, multiply the cost of solar by 30%. Compare the two numbers. If your taxes exceed the 30% of solar, you will be able to receive the full 30% tax credit (similar to a refund, in that you can get taxes back if they have been deducted from your paycheck through the year) in one year. If less, you can take portions of it over several years. Prior tax credits were limited to $2000. Now is a great time to exceed the $2000 limit by taking back the full 30% of the cost of the solar. Even without the federal tax credit, solar has many benefits and costs on average less per month than the utility PG&E.

For example, of your solar were to cost $60,000, you would be eligible for a $15600 tax credit. However, if you did not pay $15600 in taxes, you may need to receive some of that tax credit the following year. The Residential Energy Tax Credit is on line 5 of the 1040 Schedule 3 form shown below.

For commercial properties, you will have a different way of saving. You will likely be able to claim the tax credit for your property by using IRS Form 3468. Click here for instructions on how to complete the form. What a great way to help save the environment! Get back some of your hard-earned business income, and use it to do something good for yourself! Add shading for parking, while making your electric bill disappear.

Utility rebates. There are rebates for solar at some utilities. The Solar Generation Incentive Program (SGIP) in PG&E is giving a $150 rebate for each kilowatt hour of battery storage you install on qualified batteries as listed on the SGIP website. The SGIP-qualified batteries typically are expensive and negate any benefit from the rebate.

Rates are increasing, and loans have low interest rates for now.

Rebates are reducing over time, however, the SGIP rebate is still available for PG&E customers up to 15 cents per watt off the cost of a battery. Putting solar off another year just loses you thousands of dollars you could have invested into solar and your home equity, while protecting your income from federal income tax.

PG&E rates jumped another 29.3% since 2023 (shown below) and are authorized to increase again by the California Public Utilities Commission. PG&E is working on a new way to increase your rates as we speak. You may want to wake up soon and do something about it instead of being subjected to the rules of a monopoly with some of the highest prices in the nation and wanting them higher.

Please contact me for an estimate for solar installation. There is an email link at the bottom, or call or text 916-718-7546. If possible, please use the "Get A Quote" page for best results. Thank you. Jim Scott

For information about your current electric rates from your utility, please click on their logo below: